ChannelPivots Bar Chart 2.0

***

This new Renko style chart uses a single price channel concept instead of the dual price channel overlap concept.

Click on images below for zoom view

New – This bar chart is now viewed using two Custom Chart Styles

.

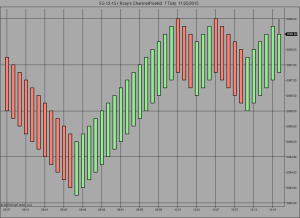

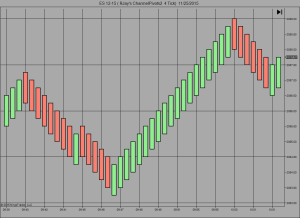

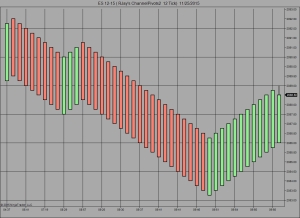

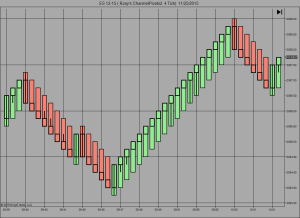

Chart Style – RJay Classic Candles

ChannelPivots – 7 ChannelPivots – 4 ChannelPivots – 12

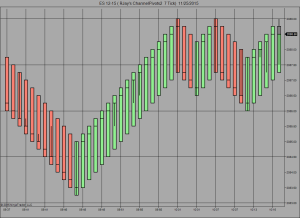

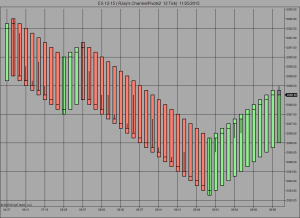

Chart Style – RJay XRay Candles

ChannelPivots – 7 ChannelPivots – 4 ChannelPivots – 12

.

(Click on images for larger view. Click on image to advance to next image.)

.

Channel Pivots Chart Description

These bars now plot with the real Open* – High – Low – Close values and are back-testable.

( *Open value is the close of the prior bar. )

New Chart Styles are selected in the Chart Data Series Style selection drop down menu.

.

Available only on the Ninja Trader platform, Although this chart type was built specifically for automated trading, it can also be used for discretionary trading.

.

What makes this chart type so interesting is that the data stream price data, is processed prior to being plotted on the price chart.

Through this processing technique,

Virtually all “undesirable” price movement is masked and does not display on the price chart.

This is very helpful for automated trading where the less variables to manage, the better.

.

Now, for the bars themselves, … there are two kinds of bars on this chart type, Trend bars and Reversal bars.

This price channel is fully dynamic and self adapting with each new bar.

By setting, the, “value” variable, in the chart type series window, you select the channel width.

To utilize this chart type effectively, you need to have a sense as to whether the market is trending or in a trading range.

Once you determine that, simply activate an appropriate automated strategy.

If you are using a strategy that needs a new bar open to execute, the trend bars on this chart type allow the earliest entry possible.

I hope you will consider this chart type, for your automated trading or discretionary trading systems.

.

Secondary Series Information( Ninjatrader 7 Only)

This product can now be used as a secondary chart series in Indicators and Strategies.

Code Examples are as follows…

ChannelPivots 4 >>> Add(PeriodType.Custom0, 4);

ChannelPivots 7 >>> Add(PeriodType.Custom0, 7);

ChannelPivots 16 >>> Add(PeriodType.Custom0, 16`);

.

BackTesting:

While testing with real time data and market replay data is most accurate and preferred. If you must back-test,

For ChannelPivots 2.0 – adding a slippage of one tick is preferred for realistic results.

.

(Please review Disclaimer prior to ordering product)

Order Ninjatrader 7 Purchase of this product.

Order Ninjatrader 8 Purchase of this product.